What is RetireOne's Constance product?

It’s a Contingent Deferred Annuity

Constance provides a lifetime withdrawal guarantee on a pool of assets maintained on qualifying custodian platforms.

It’s a Portfolio Retirement Income Guarantee

Their proprietary technology unbundles annuity insurance protections from underlying investments. This allows you to use Constance to transfer risk to an insurance company without moving assets.

And since you may choose qualified or non-qualified assets to cover, the insurance coverage does not change the tax status of the covered assets.

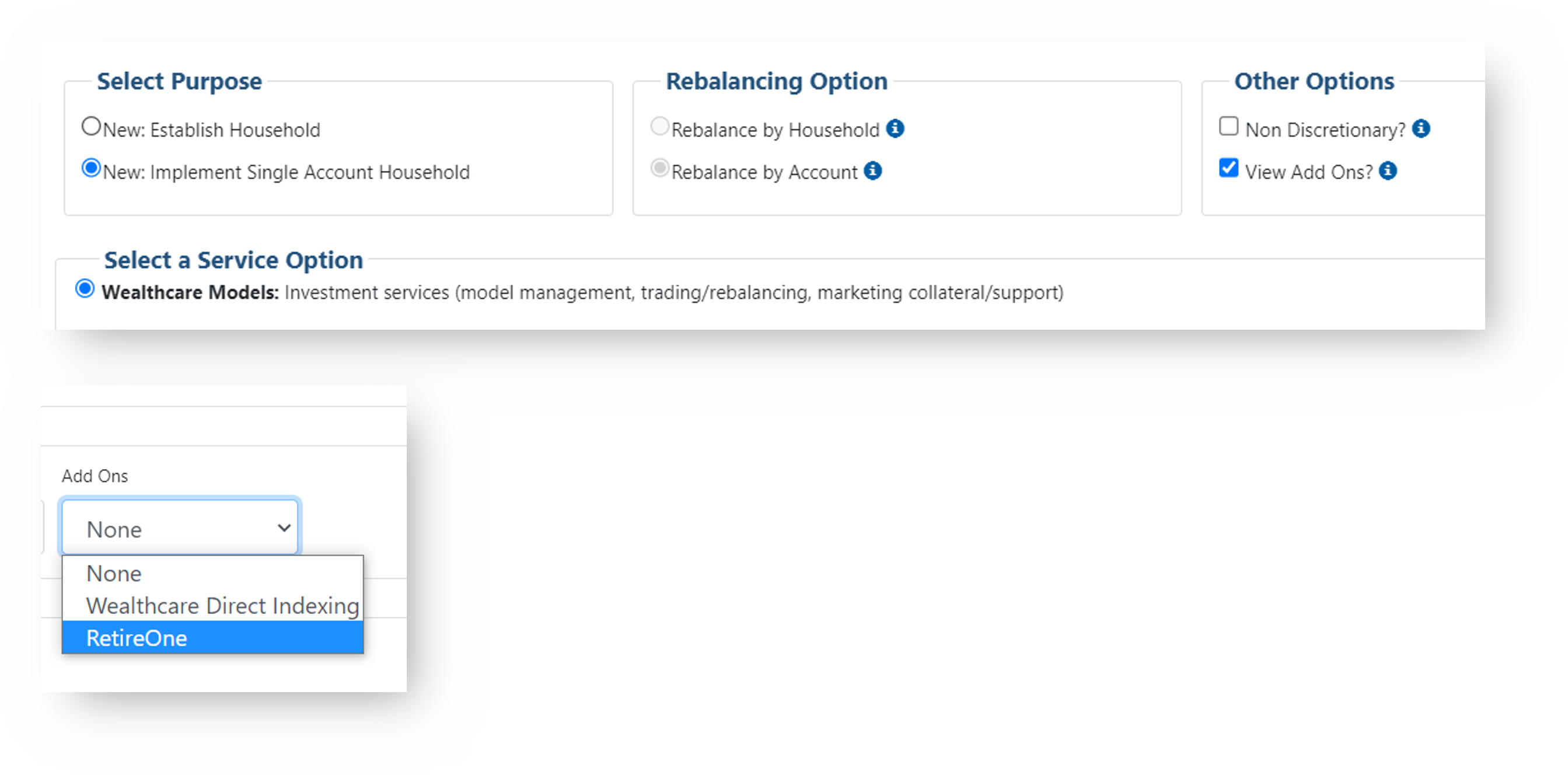

It’s used in Wealthcare Models

Using specific Constance Pure Gamma and Constance Resilient Wealthcare Models you can deliver income for life even if the covered assets are depleted (subject to the claims paying ability of the insurance company). Please read the Account Maintenance Form below before you begin.

*The Constance product is not available to LPL Hybrid advisors at this time.

Meet Julie

She’ll turn 65 in a few years and is concerned about how she’ll pay herself in retirement. Will her savings last? Will it be enough? Watch the video to learn how her financial advisor used Constance to help her convert her retirement savings into a “personal pension” and secure her spending power in retirement.

To Register as an Advisor

Register on their secure advisor portal.

Registration will initially provide you with access to advisor-only content. Once you have an account, you will be able to access all policy data on which you are the client authorized advisor.

Customized Proposal

To request a customized proposal showing the benefits of Constance for a particular client situation, contact investment consulting.

Billing Options

1. Automatic debiting of certificate fees from a Non-Covered Asset account

-

- Such as a checking/savings account or a separate account at the custodian not being used with Constance (custodian account must have checking account functionality)

- Account number and routing number must be provided for ACH/direct debiting purposes

- This allows the client to maximize step-ups

2. Automatic debiting of the Covered Asset Account being used with Constance

-

- Custodian account must have checking account functionality

- Account number and routing number must be provided for ACH/direct debiting purposes

To Onboard a Client

Register on their secure advisor portal.

Registration will initially provide you with access to advisor-only content. Once you have an account, you will be able to access all policy data on which you are the client authorized advisor.

Model Changes

If you have any questions regarding the Constance product, please contact the Wealthcare Investment Consulting Group

GDX360® Planning

** Please remember it is your responsibility as the advisor to be aware of and understand Wealthcare’s trading policies and Constance product specifics.