Lisa and Leslie LGBTQ+

Financial Planning is not one size fits all.

It is unique for every person, couple, and family. For LGBTQ+ clients it’s critical that they work with an advisor well-versed in the opportunities and challenges the community faces daily.

This case study is is a way to educate yourself on the financial challenges this community faces, become fluent in accepted and commonly used terms to engage in mindful interactions, and help you implement strategies that can be unique to them and highly impactful when helping them build their financial roadmap.

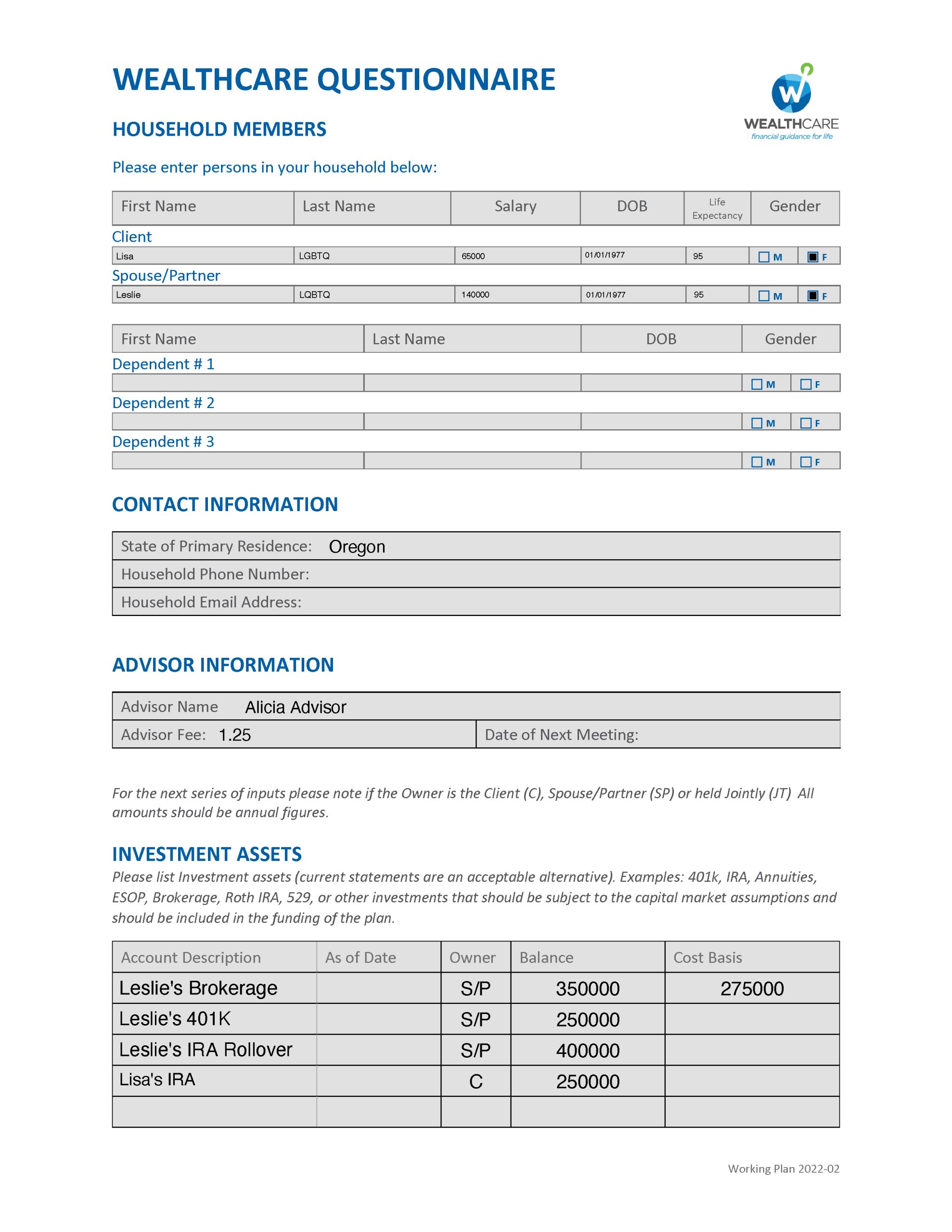

Investment Collateral

GDX360 Profile Collateral

External Partner Collateral – BizEquity

Contact Jason Early or visit the BizEquity website to learn more.

Marketing Collateral

Pride Month Collateral

Subject Line:

Financial Planning is not one size fits all.

Email body:

Hi [NAME],

It is unique for every person, couple, and family and we take pride in helping you define your financial future. In honor of LGBT pride month, I recognize that financial and estate planning can be challenging for LGBTQ+ couples but it doesn’t have to be. Here are a few concerns you may have….

-

- Do we live in a state that has not yet equalized benefits or put anti-discrimination laws into place that may affect healthcare, housing, and credit?

- Do we live in a state that has different rules about parental rights and adoption? What do we need to have in place to protect ourselves and future children from custody issues?

- In a medical emergency, do we have the proper paperwork in place, so the person of our choosing is able to make my medical decisions (medical directive)?

- Do we need a power of attorney for financial decisions? Even a spouse or next of kin cannot step in and handle your money without one.

- Should we have a domestic partnership agreement in place?

- We need someone to talk to us about establishing Traditional or Living Wills. Do you have someone you can refer that is LGBTQ+ friendly?

- As an LGBTQ+ couple, our relationship status may affect our financial situation, including healthcare, employee benefits, taxes, and Social Security. Can you help us make sure we have covered all our bases?

Good financial planning should align your money with what matters most – your unique set of life goals. You deserve financial advice tailored to your individual needs and having an advisor that understands those needs can make all the difference. I take pride in helping my clients define their financial future by tackling any challenges they face head on and incorporating each client’s unique set of goals into their plan. Your uniqueness is appreciated and you are encouraged to take your first step to financial freedom. Let me help you embrace your financial future—and guide you with clarity, confidence, and control.

[YOUR NAME]

Financial Planning is not one size fits all.

It is unique for every person, couple, and family and we take pride in helping you define your financial future.

Good financial planning should align your money with what matters most – your unique set of life goals. You deserve financial advice tailored to your individual needs and having an advisor that understands those needs can make all the difference. Together, we’ll set a path that aligns your priorities, goals, and finances to build a future you can be excited about.

Financial Planning is not one size fits all.

It is unique for every person, couple, and family and we take pride in helping you define your financial plan. Together, we’ll set a path that aligns your priorities, goals, and finances to build a future you can be excited about.

#LGBTQ #love #Investing, #InvestmentGoals, #Investments, #LegacyPlanning #FinancialAdvice #financialplanning #wealthcare #wecare #smartstrategies #smartsaving #savings #getinformed #clarityandcontrol