What are the OneTrust Home Loans Housing Wealth Solutions for WealthCareGDX?

A Housing Wealth solution that is hidden in plain sight, available through responsible access to the equity in your client’s home.

The Home Equity Conversion Mortgage (HECM) and the 55+ Specialty Reverse Mortgage could be one of the most misunderstood and underutilized resources available to your clients. A unique financial tool for your retirement age clients is becoming the go-to solution for financial advisors to solve challenges and improve outcomes for mass affluent and higher net worth clients.

Home Equity Conversion Mortgage (HECM)

A reverse mortgage that is available to homeowners who are 62 years of age or older which allows your clients access to tax-free proceeds, a growing line of credit, and flexibility of optional monthly payments*.

HECM Highlights:

- Minimum age of 62

- No monthly mortgage payments required

- Available as a line of credit

- Borrowers maintain ownership of the home

- Insured by the Federal Housing Agency (FHA)

- Used for a Refinance or a Purchase of a new home

- Recommended by financial professionals as a source for cash flow and liquidity

*Borrowers responsible for property taxes, homeowner’s insurance, maintenance, and abiding by the terms of the loan

55+ Specialty Reverse Mortgage

A proprietary reverse mortgage designed for high home values and homeowners at least 55 years of age with available equity access up to $4MM.

55+ Specialty RM Highlights:

- Minimum age of 55 (offered in select states)

- Max Loan Amount $4MM

- No monthly mortgage payments required

- Available as a line of credit

- Borrowers maintain ownership of the home

- Used for a Refinance or a Purchase of a new home

- Recommended by financial professionals as a source for cash flow and liquidity

*Borrowers responsible for property taxes, homeowner’s insurance, maintenance, and abiding by the terms of the loan

Other Solutions

- Traditional Lending: Conventional, FHA, VA,

- NonQM Residentials & Commercial/Mixed Use SBA Loans

- Doctor Loans

- Rehab Fix & Flip (3-12 months)

- Construction Loans

- Land Loans

- Lot Loans

- Many more!

Retirement Concerns Addressed

Longevity

Ensuring clients don’t run out of money

Lifestyle

Beyond the basics to have cash flow to enjoy the most meaningful time of life

Liquidity

Access to liquid assets in the event of an unforeseen events

Legacy

Leaving something for individuals and causes that matter

Strategic Uses

Asset Strategy

Avoid investment withdrawals in down markets, control taxable distributions, limit portfolio drag from cash or short term holdings

Home Purchase

Purchase a home that best suits needs in retirement.(right size, accessibility, move closer to family)

Line of Credit

Establish a growing LOC for future opportunities or unexpected expenses

Mortgage Payment Flexibility

Make payments if, when, and in amounts that are best for cash flow, tax, and retirement objectives.

Home Modifications

Fund home repairs, modifications, renovations, ADUs

Roth Conversion

Use proceeds to cover taxes from a Roth Conversion

In-Home Care

Fund or Supplement in-home care expenses

Social Security

Bridge the social security deferral gap

Gift

Accelerated an inheritance or gift to heirs or causes you support

Rethink Reverse

HECM as a Financial Planning Strategy

How do Reverse Mortgages Work?

55+ Specialty Reverse Mortgage for Higher Loan Volumes

Reverse Mortgage vs Traditional Mortgage

Published Articles

Want to be a fiduciary financial planner?

No Debt is an Island: Exploring Strategies with Reverse Mortgages

The Strategic Uses of a Reverse Mortgage

The Power of the Reverse Mortgage

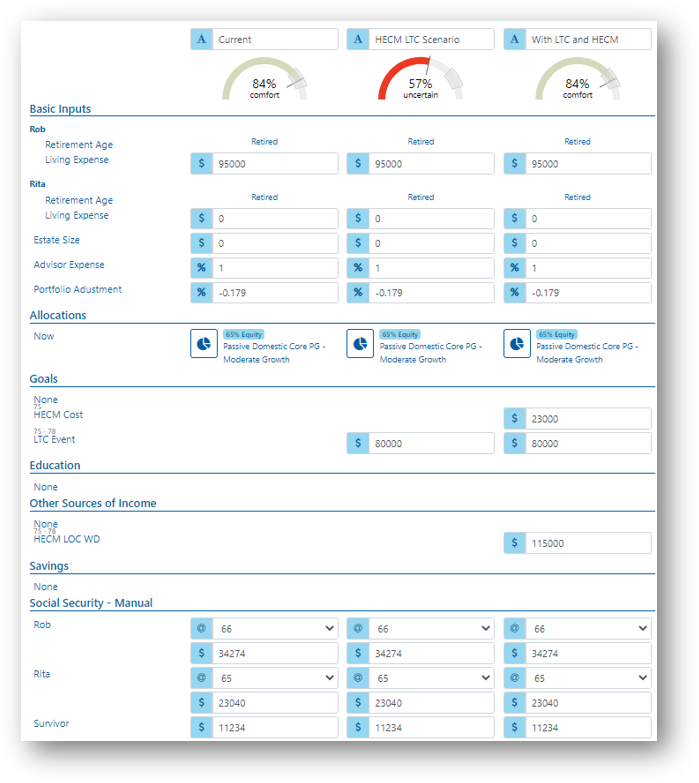

HECM - Long-Term Care Event

- Rob 66

- Rita 65

- $750k Home, $0 Mortgage

- $400k Brokerage

- $800k IRA

- Both Retired, $95k Retirement Spending

- Scenario

- Long-Term Care Event at Rob’s at age 75 and lasts 4 years costing them $415,213

Client Case Design

- Current – Comfort Zone at 84%

- Scenario 1 – LTC Event at age 75 ($80,000 year for LTC 4 years). Comfort Zone drops to 57%

- Scenario 2 – LTCi Event at age 75 with HECM – Comfort Zone at 76% ($80,000 for LTC year for 4 years, HECM cost of $23,000, Non-inflated WDs=$115k each of the 4 years)

Jumbo

- Adam 63, Single, No Heirs

- $3M Home, $1.12M Mortgage, 20 years

- $1.5M Brokerage

- $2.7M IRA

- $250K Salary, Retire at 66

- Goals

- No heirs, so no need for estate

- Wants to stay in home

- No longer saving for retirement so he can increase current spending

- $170K yr in retirement spending

- Retire at 66

- Bonus – have extra travel money

Client Case Design

- Current – Comfort Zone at 29% (retire at 66 with mortgage payments until 82 and $170,000 in spending)

- Scenario 1 – Jumbo Loan at age 63 – Comfort Zone at 94% (retire at 66 with one-time fee of $24,235 and $170,000 in spending)

- Scenario 2 – Jumbo with Travel – Comfort Zone at 82% (retire at 66 with one-time fee of $24,235, travel of $20K from Retirement – 85 and $170,000 in spending)

Wealth Strategies Team

Hank Sanders

Vice President – Equity Wealth Strategies Team

TEL 501-282-8067

hsanders@onetrusthomeloans.com

Schedule a meeting with Hank HERE

Ryan Ponsford

Senior Vice President – Equity Wealth Strategies Team

To Get Started

Complete the Web Form below. You can enter a client (or hypothetical client) request to receive consultation with one of our EWS team members.

Frequently Asked Questions

Q – Will I receive compensation for referring a client to OneTrust?

A – Only an NMLS licensed loan officer can receive compensation for mortgage products. The loan officer typically receives a commission for closing a mortgage loan, but the compensation structure may vary to include salary, bonus etc.

There is no compensation, referral fee or exchange of revenue between the advisor and the loan officer or their firms…either direction. The best way to think about the relationship is like the alliances most advisors have with CPAs and attorneys. The advisor introduces specific clients to the specialist who can add value to the client with Estate or Tax planning solutions to enhance the clients’ comprehensive plan. There is not exchange of revenue between the specialist and the advisor…just each working and being compensated for their specific work for the client.

Q – Can I use this product with any of my clients?

A – No, for a HECM, your Client has to be at least 62 years of age to be eligible. If married, at least one spouse has to be 62 yrs old. For a Jumbo, client must be 55 but that is not the case for all states. Contact OneTrust for specific client options.

Q – Is there a recording of the November 2022 Launch Webinar

A – Yes, Click Here to watch