Counsel Trust Company is an independently owned, fiduciary, non-depository trust company…. established to provide corporate trustee services to outside investment advisory, accounting, and legal firms.

Listen to Ed and Brandon Crooks with Counsel Trust Company, our new trust company partner, present “Modern Trust Concepts”. This recording of October 2020’s interactive Practice Management webinar covers the following topics:

• Advisor Business Threats and Opportunities – Why the ability to offer trust services to your clients is vital in client retention and building your AUM

• How does a relationship with an advisor friendly trust company operate?

• When should clients consider a corporate vs. an individual trustee?

• Directed versus delegated trusts – what’s the difference and why does it matter?

• Various trust examples where partnering with Counsel Trust may be beneficial.

Webinar Recording

Password: WCM_2020

Contact

Wealthcare Advisor

- Manage trust assets and serve as the primary client relationship contact

- Trust assets are held by the advisor firm’s preferred custodian

- Periodically transfer funds from the trust to the SEI cash account for making beneficiary distributions and payment of fees

- Generate performance reports and conduct periodic meetings with the client

Fiduciary Services Roles and Responsibilities

Counsel Trust Company

- Interpret the trust document and administer the trust, including making discretionary beneficiary distribution decisions

- Coordinate the preparation and filing of trust tax returns – 1041 and K1 with clients’ accountant or CTC’s vendor accountant

- Generate annual or more frequent principal and income trust statements

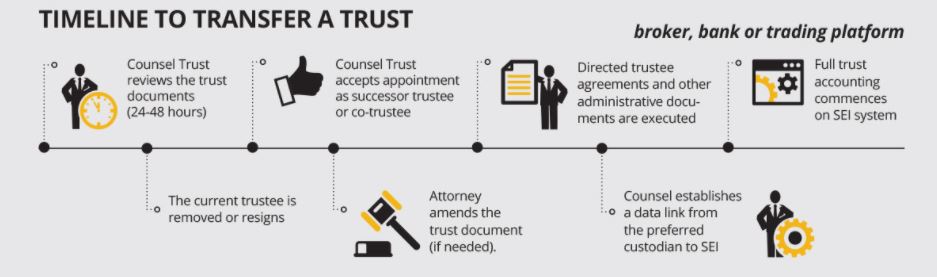

- Guide the process of creating new trusts or the transfer of existing trusts – coordinating with legal counsel as necessary